Spend Your Way Out!

"How's business?"

Let that be the question of the year—or perhaps of the recession. Ask it aloud and you're sure to be greeted with an "ehh," an "ugh," and maybe even a guttural growl or two.

The fact is, the business landscape has changed due to financial constraints. Anyone who says the economy isn't weighing hard upon them is lying. What Americans have been feeling for the past year was finally confirmed in December, when the government officially announced we were in a recession—that we'd been in one since December 2007, in fact, and it might not lighten up anytime soon.

In talking to analysts, vendors, and corporate decision-makers, a distinguishable, repeatable strategy emerged: You can't afford to do nothing. The idea was echoed throughout conversations—now is not the time for CIOs to sit upon their hands. It's time to act—to be proactive, in fact—and to make changes that will ensure your business will still be around come 2010.

For many business leaders, the economic downturn has rung a few bells. Dot-com bubble and Y2K, anyone? In a recent report on technology in a recession, AMR Research President and CEO Tony Friscia wrote that the recessionary blip in the 1990s paved the way for a less-than-rocky path in the current day. He writes, "Recovering from the bad dot-com/Y2K hangover changed how companies approached [technology] spending and management. The biggest result has been that [technology] is now a core part of the business strategies of the best-run companies, which means technology spending won't be hit nearly as hard as it was in 2001." Still, organizations are tightening budgets and reallocating spending.

Even before the official word came down, public relations firms began throwing around the "recession" buzzword—even though optimists hoped it might only be a scare tactic. Soon thereafter, however, the idea of CRM being recession-proof caught fire. Sure, CRM initiatives aid in retaining customers and keeping the relationship going. But when business is slowing and customers start to drop off, how does a business pull ahead? According to some, drastic measures must be taken—and these may require you to spend some money. So don't stash the cash just yet.

SPEND SOME TO WIN SOME

Kevin Ko, director of information systems at DriveCam, a company that provides feedback on drivers via onboard video event recorders, admits that business since 2007 has not been great. The San Diego–based company has been hit hard by the economy, he says—and customers aren't biting as they once did. "The recent couple of months have been really grueling for us," he says. "We had to cut down about 20 percent of our labor force."

DriveCam tightened its purse strings in other segments, too—in what Ko calls "fluff areas." One particular expenditure remained accounted for, although it was debated when reallocating the yearly budget. For the past year, DriveCam had been relying on the expertise of software-as-a-service (SaaS) consultancy Bluewolf to aid in its Salesforce.com CRM implementation.

Originally brought on to make the CRM solutions run a bit smoother, Bluewolf now provides DriveCam with its OpenSupport offering. Basically, every month, a Bluewolf consultant comes in, works with the CRM, updates, troubleshoots, and makes sure it's fully optimized. Ko says since bringing on the extra administration, the ROI is remarkable.

"We are cutting back on spending, but we are keeping what's important based on ROI. We believe that will make us stronger and will keep us going—not only surviving but thriving." Ko adds that keeping up with the Salesforce.com releases is a challenge unto itself—something that the company's sole CRM administrator could not do on his own.

DriveCam is an innovative business, using video technology to relay and change driving behavior. That being so, staying in line with technology is an essential business strategy for the company—one that Ko refused to let fall by the wayside, even in a recession. He acknowledges that enlisting a professional services organization is costly, but, even in times like these, vital.

The hope, he says, is that continually improving upon DriveCam's CRM systems will help the company weather the rough patch. "We're pushing sales and marketing as an entire company. We are trying to regroup and work as one to move more effectively." DriveCam's strategy, he points out, is more than piecemeal initiatives thrown together to drive sales. "It's about building a culture to survive the storm."

THEY WON'T COMMIT

DriveCam's continued investment in Bluewolf is a tad counterintuitive considering the fact that many analysts predicted consulting would be an early victim of budget cuts. In fact, Chris Andrews, a Forrester Research analyst and author of a report about selling technology services during an economic downturn, continues to believe that professional services could see some major cutbacks in a recession.

Along those lines, Umberto Milletti, chief executive officer and founder of social sales application provider InsideView, seems to agree. "These days anything that requires professional services, companies are very hesitant to do it," he says, advocating the SaaS model for that reason. But are organizations cutting back when they might need consultants the most? When the road gets rocky, organizations need hand-holding more than ever. However, this means they might be looking to a vendor for more than the product sold. "Customers right now are looking for guidance and a way to go through the recession," Andrews says.

Despite the expense, cutting services might be riskier than keeping them around, Andrews affirms. "There is a positive ROI associated with outsourcing," he adds.

Pricing becomes increasingly important as companies re-evaluate spending and project expenditures. With the future uncertain, companies are hesitant to commit to licensed, long-term contracts. The risk of a new project is enough on its own—throw a three-year lease on there, and you can wave goodbye to the penny-pinching customer.

"Companies in a recession are focused on price and flexibility," Andrews says. "They don't want to be locked in. They are concerned with low or up-front cost. They don't want to be locked into a long-term agreement that might be significantly impacted or affected as business conditions determine."

If this is true, you'd think organizations would be running into the arms of low-cost, subscription-based service providers. Well, not yet, but it's becoming truer: Gartner survey results indicate that 90 percent of organizations plan to expand upon SaaS projects in the next year. But just because software is cheap, doesn't mean customers are signing on in droves.

Even free offerings come with a price tag. Often it's a free trial or it's a solution that's too lightweight—or it's a company that's still a bit wet behind the ears. And with the economy shaky at best, businesses want stability, not insecurity of whether the vendor will be in existence several months down the road. "Tech markets in general are driven by innovation so the pressure for customers to innovate is never going to go away," Andrews says. Yet, as young vendors struggle to break through the surface, does innovation suffer?

Leximancer, a social insight and text analytics company, is still in its infancy, but CEO Neil Hartley says the Boulder, Colo.–based company's experience in today's economy seems to contradict what most would think an emerging business is facing. "Business in the last three months has been really positive and growing positively," he shares. "I think people are looking at how and where consumers are concentrated and are still trying to innovate, particularly in the social media space."

TAKING THE PLUNGE

"It's going to be a hard market for bold new offerings," Andrews admits—but not an impossible one. The boldest moves, after all, might just be the ones that stay afloat in this economy—and, hopefully, help businesses swim ashore as the economy stabilizes.

Many companies seem to think it's too late to salvage 2009, looking to 2010 for the start of any substantive changes. Look at the product-release schedule from heavyweight vendors such as Microsoft and Oracle—their sights are set on 2010. It's as if 2009 is being skipped over completely in terms of rolling out new projects.

Dan Adams, B2B sales and marketing researcher and author of New Product Blueprinting, offers B2B executives a "recession survival kit." One of his tips is to focus on engaging customers—prospective and existing—for marketing, sales, and development purposes. His core advice is for B2B workers to schedule one-on-one interviews with customers to gauge their opinions on business. Find out what customers want. Let them know that their patronage—and their opinions—are valued. Doing so will foster loyalty and provide the vendor with tremendous feedback for upcoming development projects.

To that end, Adams says that suppliers can do themselves—and their customers—a world of good by demonstrating superb listening skills and acting upon what they hear. "We know wallets will be shrinking," he says, proposing that the main question on sellers' minds will be: "Our customers will spend less in 2009 than in 2008. How can we get a bigger chunk of that wallet?"

It's essential to identify the changes in customer spending and how they'll affect your business. You should do some re-evaluation internally, too, Adams says. "Executives need to step back and say, ‘Where am I wasting resources?'" he says. "About half of R&D is wasted," he adds. "If I was an executive and I wanted to stop wasting, I'd make sure that on every project we had proof that the customer really cared about that."

Adams says that's where quality customer feedback comes in. He isn't talking about a 10-step online survey. He means scheduling one-on-one interviews with B2B executives—something, he says, that only about two percent or three percent of organizations take the time to do. "The real key is if we can figure out how those customers make their buying decisions."

Lori Wizdo, vice president of marketing for performance management company Knoa Software, stresses the same point: "It's all about having visibility of where you need to take remedial action." Wizdo tells the tale of a United Kingdom contact center that did a deep evaluation of what its employees were finding valuable and useful. The organization soon discovered that employees thought of a training program costing $100,000 annually as essentially useless. Cutting the program instantly lifted a financial weight off the organization—and an annoyance off the employees.

FOR RICHER OR FOR POORER

What happens to loyalty in a recession? Adams ventures that loyalty doesn't necessarily go out the window when companies hit hard times. In some instances, it can be stronger than ever before, as organizations contact their vendors more frequently, seek transparent relationships, and spend more time going over budgets and realigning priorities.

"Loyalty is there," Adams says. "Particularly with the kind of customers we want to do business with. The valuable customers—the ones that are looking for value and who are looking to create something in their own rights for their own customers—they want to work with suppliers who deliver those same values."

Paul Greenberg, president of CRM consultancy The 56 Group and author of CRM at the Speed of Light, writes in a presentation on "CRM in a recession" that poor economic conditions change customer behavior. But loyal customers are the ones who will continue to spend with you—even through tough times. "Advocates are the paradigm," he points out. "Even in a downturn."

THE LONG HAUL

"During a recession you don't want to forget about the long term. At the same time you have to shift priorities in getting through the current downturn," Andrews says. With a recession come opportunities. Adams says those who are able to pull ahead in times like these will really win when we come out of 2009. "The companies that have the high beams on will develop better longer-term products, but when they come out of the recession in better shape, they will actually take share away in the short term."

Maybe companies will come out of the recession with more than just maintained bank accounts. "There are tremendous amounts to be learned in an economic downturn," Adams says. "Some of the smart companies will make capital investments in a downturn and then when the economy is coming back up, they will be ready." He goes on, "Some will learn what their customers want and will be ready to roll out new products and will have pulled tighter relationships with those customers."

STRATEGY: SELL, SPEND, SAVE, SUFFER?

Obviously no recessionary strategy is one-size-fits-all, but one overall message seems to ring out consistently: Do something. "You can not just go under your desk and suck your thumb and wait it out until next year," Milletti says. "That's the losing strategy. During these times—this is when great companies emerge."

Milletti adds that companies have several choices when struck with financial burdens: "You can keep doing what you're doing and hide and hope things get better; or, you can take this opportunity to rethink how you go to market and look for ways to be more efficient."

Greenberg offers tips for surviving—his main three points revolve around providing the customer with communications, value, and service. He adds that operating as a business leader, rather than as a salesperson, can go a long way.

"In bad times, the best companies batten down the hatches and use the lull to strengthen their position and brand. They take advantage of the tough times to take market share, growing faster than their competitors as they come out of the downturn," AMR's Friscia writes. "During these times, companies need to focus on what they do best. As one executive said to me two weeks ago, ‘We get lazy in good times, but now we are forced to stop doing what's not working and get better at what we do well.' It sounds like a cliché, but I'm always amazed by how many companies fail to take this very simple advice."

SIDEBAR: Top 5 Tech Tips

The right approach to technology remains the same, regardless of the economic circumstances: Take the time to know what you need before you waste precious resources. Here’s how.

- Generate disruptive business models: Stay relevant not just through innovation, but with organizational structures, competencies, processes, and partnerships.

- Harness the creativity of all employees: Look internally to drive grassroots innovation. Creatively address leadership frameworks and employ social computing tools.

- Reorient the entire organization around customers: Let your customers dictate research-and-development priorities.

- Nurture regional ecosystems to best serve emerging markets: Evoke entire communities, not just individuals.

- Sustain competitiveness with innovation-management tools: View innovation as a continual process—not just a problem needing to be solved.

—Forrester analyst Navi Radjou, “The Tech CEO’s 2009 Innovation Agenda,” December 2008

SIDEBAR: Strategy Will Squash the Recession

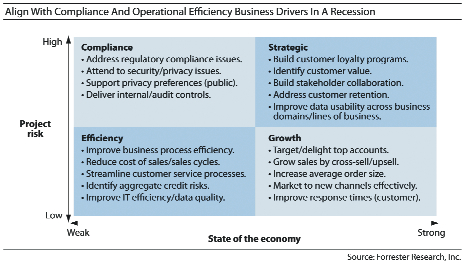

In recessionary times, many are pulling the plug on proposed projects—trying to penny-pinch and cut unnecessary costs. Ray Wang, an analyst with Forrester Research, cautions against such haste. In fact, he says, the expense of abandoning in-the-works projects might exceed the cost of following through. Instead, organizations should look to breathe new life into in-flight projects.

In “Five Steps to Building a Recession-Proof Packaged Applications Strategy,” Wang offers a plan that aligns with business drivers, gains executive support, and makes the company more efficient. Wang says that appeasing the executive team and reinvigorating current application strategies comes down to two goals: cost-saving and cost-avoidance (in the form of regulatory compliance).

“A number of clients are cancelling [implementations]—but leaving so much effort and momentum on the table,” Wang says. “What you’re looking [to prioritize] is a project that addresses regulatory compliance, something you have to do, or something that will help you save money.” Wang’s five-step approach:

- Align your strategy with recession-relevant business drivers.

- Organize stakeholders for sustainable change.

- Identify opportunities in commoditized and differentiated processes.

- Select effective technology strategies.

- Re-examine your vendor relationships.

.

.

SIDEBAR: When the Bottom Line is the Top Priority

Here are some low-cost or no-cost CRM strategies for when money is tight—plus some counterintuitive approaches to spending your way out of the recession.

- Conduct in-depth interviews with your best customers to find out what they want from you.

- Fire your worst customers.

- Engage in grassroots innovation with employees and customers.

- Set plans and goals for the future and share them with your customers.

- Train and retrain employees.

- Ask customers and employees what they don’t need or want from you.

- Sign up for free trials, but make sure to include time as a cost.

- Look to BI and analytics solutions to get more out of your CRM data.

- Clean up your data using a low-cost data cleanse solution.

- The little things count—handwritten thank-you notes, remembering your client’s favorite team, picking up the phone rather than sending an email.

Editorial Assistant Lauren McKay can be reached at lmckay@destinationCRM.com.

Every month, CRM magazine covers the customer relationship management industry and beyond. To subscribe, please visit http://www.destinationcrm.com/subscribe/.

Here's a quick link to more of this month's special coverage — The Recession Issue.