New Social Media Not Helping Sales

Despite the popularity of social media tools -- from friend networks to content-sharing sites -- companies are struggling to locate enough social-media-generated revenue to justify the time and resources expended on them, according to the results of a recent survey conducted by sales consultancy ES Research (ESR) Group. Few companies are seeing substantive results, and yet many expect social media to be the solution to what has been a steady decline in productivity for many sales departments. The survey results indicate, however, that without a working overall sales strategy in place, no amount of involvement in social media tools will matter.

In the early days, many companies banned employees from logging onto social media sites deemed "unbusinesslike," such as Facebook. As such networks have opened up to form all types of relationships, though, companies are seeing business value -- or the promise of value -- from what used to be seen as all-personal Web sites.

Between late February and mid-March, 392 B2B sales representatives responded to the ESR Group survey regarding their use of "new social media" tools. Based on the results, along with interviews with sales professionals, sales training companies, and technology companies, ESR Group's list of the most commonly used social media sales tools are, in descending order:

- LinkedIn.........................86 percent

- Hoovers or OneSource......61 percent

- Facebook........................50 percent

- Plaxo;............................48 percent

- Twitter............................31 percent

- Jigsaw............................26 percent

(According to ESR Group's methodology, Hoovers and OneSource -- despite being separate companies -- were combined for survey purposes "because of their similar services.")

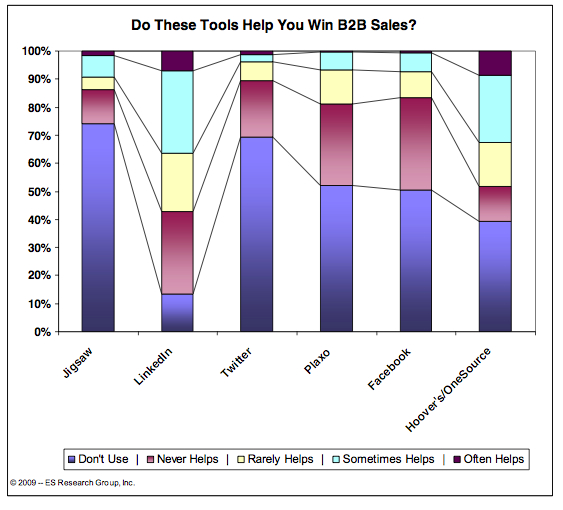

Survey recipients were then asked a single question about each of these tools -- "Do these tools help you win B2B sales?" -- with available responses of:

- don't use;

- never helps;

- rarely helps;

- sometimes helps; or

- often helps.

According to the study, claims that these tools "sometimes" or "often help" B2B sales were underwhelming, at best. The responses break out as follows:

- LinkedIn..............................36 percent

- Hoovers and OneSource..........33 percent

- Jigsaw................................10 percent

- Facebook..............................8 percent

- Plaxo...................................7 percent

- Twitter.................................4 percent

The problem plaguing sales departments, according to Dave Stein, chief executive officer and founder of ESR Group, is that sales lacks structure, often looking for "quick tips [and] silver-bullet shortcuts." This is why, he adds, the B2B sales world is constantly looking for the next sales trick, the next revolutionary book, or even the next acronym.

ESR's concern, Stein says, is that, given the sales department's "quick-fix" attitude toward problem-solving, all the hype and noise around social media -- in particular, mostly unproven and unstructured channels such as Twitter and Facebook -- will only serve as a distraction. Stein warns of salespeople who misguidedly assume that social media empowerment means they no longer have to focus on Sales 101 -- a mistaken view, not unlike perceptions of CRM in its early days, that social media is going to be "the savior."

What social media should not be doing, Stein says, is taking the place of investments in core sales methodology -- that is, people, infrastructure, tools, processes, supporting technology, education, and training. "All of these things are expensive," he says. "They take time [and] focus -- but that's what works, that's what helps companies be effective from a selling perspective. We're concerned about the distraction factor more than anything else." (ESR Group, of course, is a sales methodology company.)

Stein is not in any way denying the underlying value of social media -- it's just not happening as fast as the industry and media make it out to be, he says. He sees B2B opportunities in of these channels, both inside and outside of his own business. The challenge is, once a connection has been made through channels such as LinkedIn or Twitter, salespeople still need to have the knowledge and resources to follow through to conversion (e.g., a sales proposal, a product demonstration, or a detailed explanation of your offering over your competitors). "If I don't have the skills, the tools, or [the] people...then that sale will never happen," Stein says.

Sales is eternally hard-pressed to deliver revenue, and if the old, traditional methods weren't working, it's likely that they failed because of a lack of senior-level investment, the appropriate funding, and the focus, Stein says. Bringing social media in the picture will fail, he says, if it's not part of an overall go-to-market strategy. For the moment, he warns, failure will abound: "It's going to be used by the seat of the pants.... There are going to be abuses [and] companies are going to get in trouble." Social media tools, like any other, have to be assessed and implemented based on the current and future value they have on the sales process, Stein says.

For smaller organizations, social media tools seems to be relatively more productive. For companies lacking big budgets to get their name out there, make connections, keep track of their competitors, or learn from the industry, these tools can be a major help, according to ESR Group's findings. It's the big enterprises that will be slower to find business value in -- and, therefore, effectively to adopt -- social media tools. For those $10 million, $20 million, $30 million deals -- the most-complex B2B sales -- experiments with social media, at the moment, may serve only to take away from proven methods that work, Stein says.

Where social media is most applicable in business right now is in marketing and advertising agencies who need to absolutely be getting the brand out into the market, Stein says. Marketing, he adds, should be responsible for the corporate blog and connecting with customers. Moreover, marketing has the responsibility of monitoring the brand perception and finding out the trends in the industry, information that can easily come through social media. Still, there are many companies who won't be using social media, at least for three to five years, Stein says. When those businesses finally do join the fray, Stein says he anticipates it will be in a very constrained, restricted, and disciplined way, simply because of the unregulated nature of the medium.

Even if you're not ready to take a full-on approach, Stein says, it doesn't hurt to get started, even if it's just to listen: Find your competitors, your customers, industry analysts, thought leaders. But until you can justify the time -- justification in the form of hard-number revenue expansion -- he suggests you limit the amount of time you spend with social media. Otherwise, Stein warns, "you can get lost in it."

Highlights of the ESR Group's survey, "The New Social Media: Do They Enable B2B Selling?" can be found here (free registration required). The full report is available for a fee at ESR Group's site.

News relevant to the customer relationship management industry is posted several times a day on destinationCRM.com, in addition to the news section Insight that appears every month in the pages of CRM magazine. You may leave a public comment regarding this article by clicking on "Comments" at the top; to contact the editors, please email editor@destinationCRM.com.

Related Articles

Powered Powers Up Social Offering with 3 Acquisitions

15 Jan 2010

After closing deals at the end of 2009, the social media agency aims to deliver a broad suite of social media capabilities.

Jive Acquires Filtrbox; Reaches Record Revenue in 2009

15 Jan 2010

The social business software provider buys a social media monitoring company and plans to extend social insight across the entire enterprise.

Get Social and You’ll Sleep Better

11 Jan 2010

Improve the customer experience with a content-rich, social-driven site.

Socializing with NetSuite and InsideView

10 Nov 2009

NetSuite's first "premier partner" is a vendor that specializes in making social media work for the enterprise.

Driving Bigger Sales Down Under

01 Oct 2009

The TAS Group steers FleetPartners toward its sweet spot with an influx of higher-quality deals.

Twitter: Social Media for the Sophisticated User?

21 Jul 2009

"As people become more savvy with social media," says the managing partner of Anderson Analytics, "they pick up Twitter."

Sales Performance Management Is the New Necessity

07 Aug 2009

CRM won't solve everything. You still need skilled salespeople to get it right.

Small Businesses Show Social Networks Some Love

04 Jul 2009

AMI-Partners research indicates that small businesses aren't as slow to get social as some have contended. What's driving adoption? The blurring of the lines between professional and personal uses of social networking.

Marketo Brings Social Into Sales Insight

19 Jun 2009

Incorporating data from Jigsaw, Demandbase, and LinkedIn, Marketo aims to empower sales with its native Force.com application.

InsideView's Vision Of Social Sales

13 May 2009

The vendor's new SalesView Buzz tab aggregates social networking information and integrates the data directly into CRM systems, providing richer context around sales leads. The problem? A significant amount of data on the social Web is simply wrong.

Jigsaw Cleans Your Cloud

30 Apr 2009

The online business directory's new Data Fusion product targets issues of data quality.

Web Analytics Meets Social Media

16 Apr 2009

Webtrends and Radian6 are the latest vendors to partner up for companies hoping to monitor and respond to online conversations.

The 4 Fail Whales of Social Media Marketing

02 Apr 2009

Web 2.0 Expo '09: Social media thought leaders Charlene Li, Jeremiah Owyang, and Peter Kim discuss the barriers to social media marketing, and how to encounter them without going "over capacity."

Social Media Marketing Can Succeed for Leaders -- and Laggards

31 Mar 2009

A recent report reveals what even flawed marketers might achieve with efforts involving social media.

Retailers Better Buy In to Social Media

27 Feb 2009

eTail West '09: Companies are either wallowing in uncertainty or else diving aimlessly into unknown waters -- either way, the brand takes a hit.

Oracle Shines Up Siebel and Social Computing

12 Nov 2008

Big Red's acquired powerhouse gets a major update, and adds sales gadgets to its social initiative.

B2B Marketers Still Hesitant to Get Social

23 Oct 2008

Forrester report shows that B2B marketing, unlike its B2C counterpart, may be lax in diving into Web 2.0 business efforts.

Social Media Wants You

10 Oct 2008

Eloqua Experience '08: Charlene Li, the co-author of "Groundswell" and former Forrester Research analyst, offers simple advice for taking on social media: Just do it.